As we head into the height of tax season, the complaints have started rolling in here at WKYC.

Everything from confusing bills to trying to get a live person to help. That's often been the case with RITA, the agency handling our local taxes.

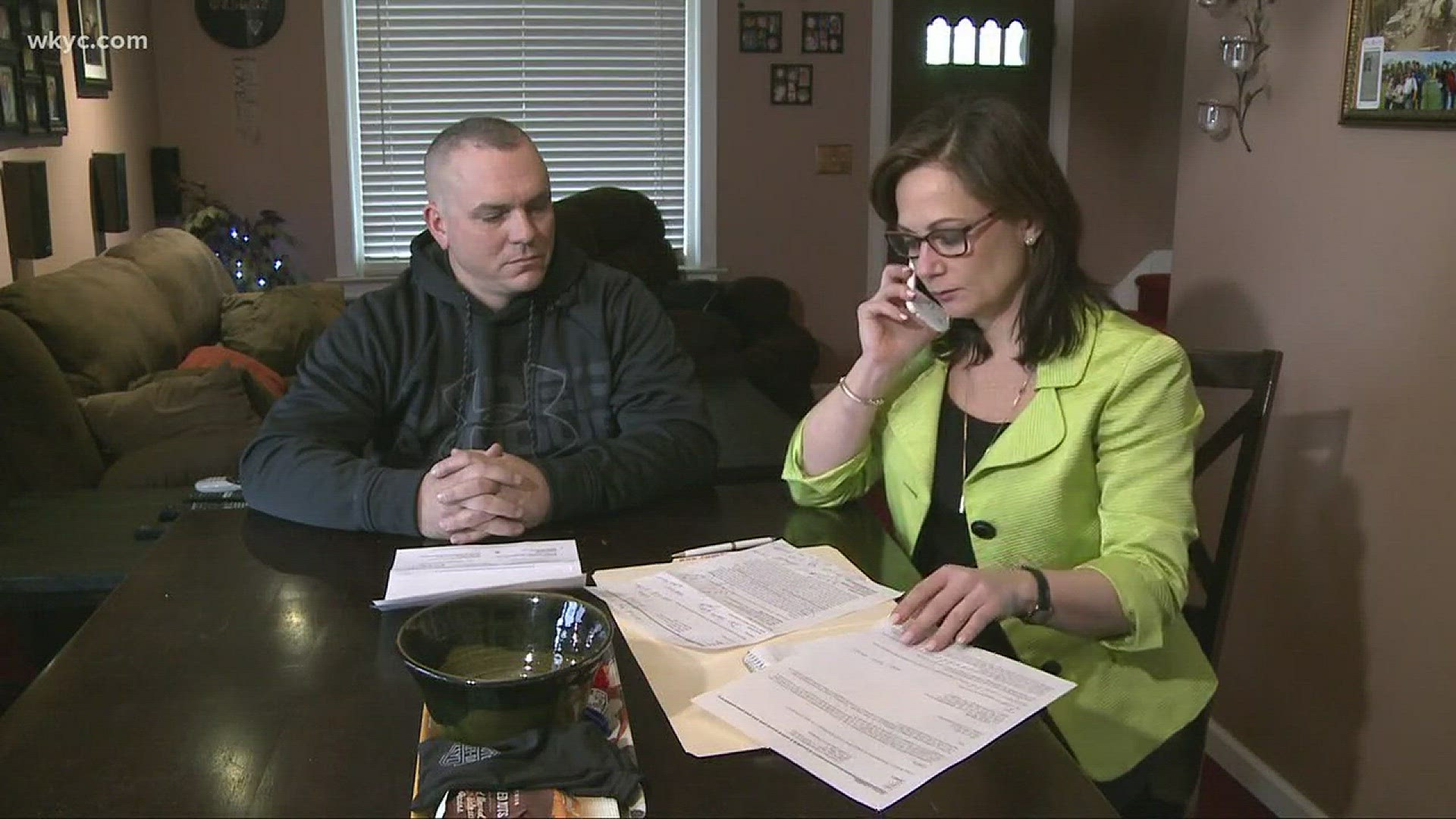

I have done several stories on RITA over the past year. Most not so flattering, even though they claim taxpayers are very happy with them. So when a viewer wrote us about being charged a late fee, even though they owed "him" money. It was time to pay the tax man a visit.

"I feel there is an injustice with the RITA system" says Jason Frank, a Marine of four years and a hardworking resident of Brooklyn for the past fourteen.

So, the last thing he needed after losing his wife to breast cancer last December was this tax bill from RITA saying he owed a $150 late fee.

"It's not that its $150. It's the matter that I'm probably not the only one out there that's getting screwed like this and I feel this had to come to light," said Frank.

You see, not only did he pay his taxes according to RITA's own bill, he "overpaid"... by more than three dollars. But since they say he never sent in his forms, he still owes the late fee, less that three dollar credit.

"I asked if that fee could be waived because of the situation that I just overpaid by a little bit and I was told no,” said Frank.

That's because this wasn't his first run in with RITA. A few years back the tax rate in Brooklyn went up. Jason says no one from the city nor the agency notified him and his tax program didn't catch it. It wasn't until six years later that RITA billed him nearly $12,000 in back taxes, penalties and interest.

I called RITA to see what this latest snafu was about.

"Let's assume he did file late. But even if you get a credit back, you still hit with a late fee?" I asked.

"That's the kind of thing we'd be looking into," says Amy Arrighi, RITA Chief Legal Counsel.

It's issues like these that have led people to criticize the agency. Something they called unwarranted, in an interview I did with them last year.

"If we're doing as poor as some have said, why would word of mouth from one municipality to the other be that the best option in the state of Ohio is the Regional Income Tax Agency," asked Don Smith, Executive Director of RITA.

We're hoping RITA puts their money where that word of mouth is and rectifies this situation. They assured us we would hear back on Friday.