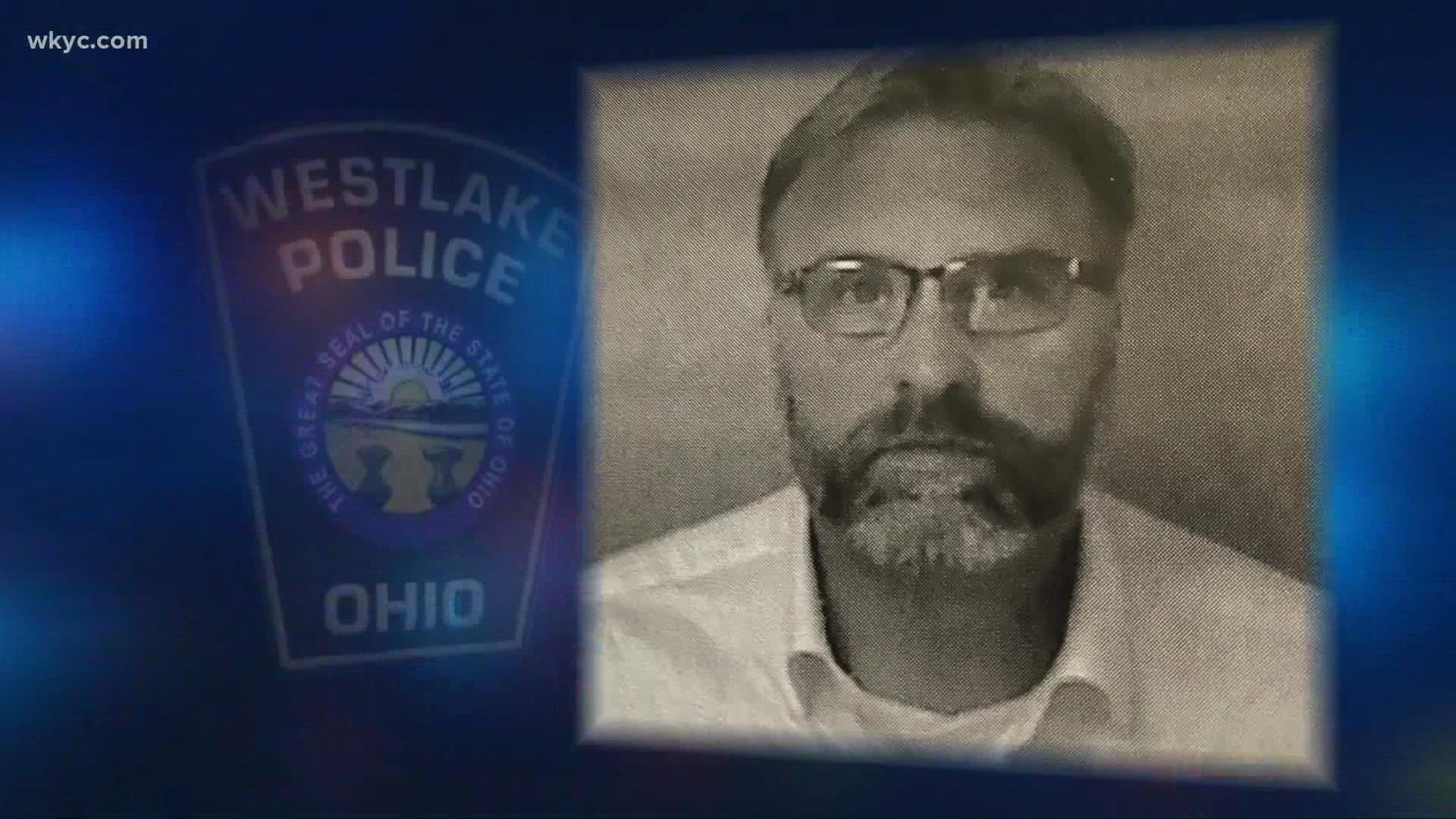

WESTLAKE, Ohio — The fate of a former Westlake financial adviser is now in the hands of a jury.

Closing arguments were held Monday in the case of 50-year-old Raymond Erker, who federal investigators accuse of stealing more than $9.3 million from 54 investors in an alleged Ponzi scheme. Authorities say the situation started in January of 2013 and continued through January of 2018.

If convicted, Erker could face more than 20 years in prison.

This comes just a few weeks after one of Erker’s co-defendants – Tara Brunst of Olmsted Falls – pleaded guilty to multiple charges in the case, which include conspiracy to commit mail and wire fraud, mail fraud and three counts of wire fraud.

Another co-defendant – Kevin Krantz of Olmsted Falls – is also accused in the case.

"As part of the scheme, members of the conspiracy sold investments to clients that they misrepresented as annuities and senior secured notes with no risk of loss and with a guaranteed rate of return," according to a previous press release from the Department of Justice. "Without the approval or consent of investors, investor funds were diverted to other entities they controlled and personal bank accounts. Court records state that to keep up with promised rates of return, Brunst and the alleged co-conspirators falsely represented that payments to previous investors were rates of return and interest when the payments were actually new investor funds, the trademark of a Ponzi scheme."

The Department of Justice also says that Brunst and the alleged co-conspirators failed to disclose to investors that they had substantial or limited ownership interests in companies receiving investments from the scheme.

Editor's note: Video in the player above features a previous report connected to this case from Sept. 9, 2020.

The plan ultimately resulted in $9,366,976.37 stolen from investors, according to the Department of Justice.

“In an attempt to avoid being detected, office fronts were set up in Delaware and Nevada,” the Department of Justice added. “The office fronts were complete with false websites and account statements.”

MORE CRIME: